By Patrick O'Neil with Amra Selimovic

Addendum: On March 27, 2023, regulations were introduced amending the Prohibition on the Purchase of Residential Property by Non-Canadians Act. The regulations, which were registered on March 27, 2023 (the same day as being introduced) with immediate effect, contained changes that were in response to concerns raised by various stakeholders regarding unintended consequences of the Act.

These changes include:

- Repealing the provision that included vacant land as a prescribed real property;

- Increasing the threshold for corporate control from 3% to 10% of the value of the equity in the Company or the voting rights;

- Broadening exceptions for temporary residents, provided that the person has 183 days or more remaining on their work permit/authorization on the date of purchase; and

- Introducing an exception for residential property purchased by a non-Canadian for the purposes of development, including commercial, industrial and residential development.

The Government of Canada introduced the Prohibition on Purchase of Residential Property By Non-Canadians Act (the “Act”) in June of 2022. The Act is now in force as of January 1, 2023.

The Act prohibits non-Canadians from purchasing, directly or indirectly, residential property in Canada for a period of two years.

The Act has a number of exceptions, including property acquired by temporary residents, refugees, and spouses or common-law partners of Canadian citizens, permanent residents, temporary residents, refugees, or registered “Indians” under the Indian Act. The Act also does not include property acquired as a result of death, divorce, separation or by gift.

In terms of property owned by corporations, in addition to corporations formed in jurisdictions outside of Canada, the definition of “non-Canadian” includes corporations formed under the laws of a jurisdiction in Canada having shares representing 3% or more of the value of the equity of the company or 3% or more of the voting rights that are directly or indirectly owned or controlled by a non-Canadian.

With respect to the types of properties captured by the Act, it applies to residential real property located in Canada, including:

- detached homes or similar buildings which contain three dwelling units or fewer; and

- semi-detached homes, rowhouse units, condominium units or other similar premises that are (or are intended to be) separate parcels of real property owned (or intended to be owned) apart from other units in such buildings.

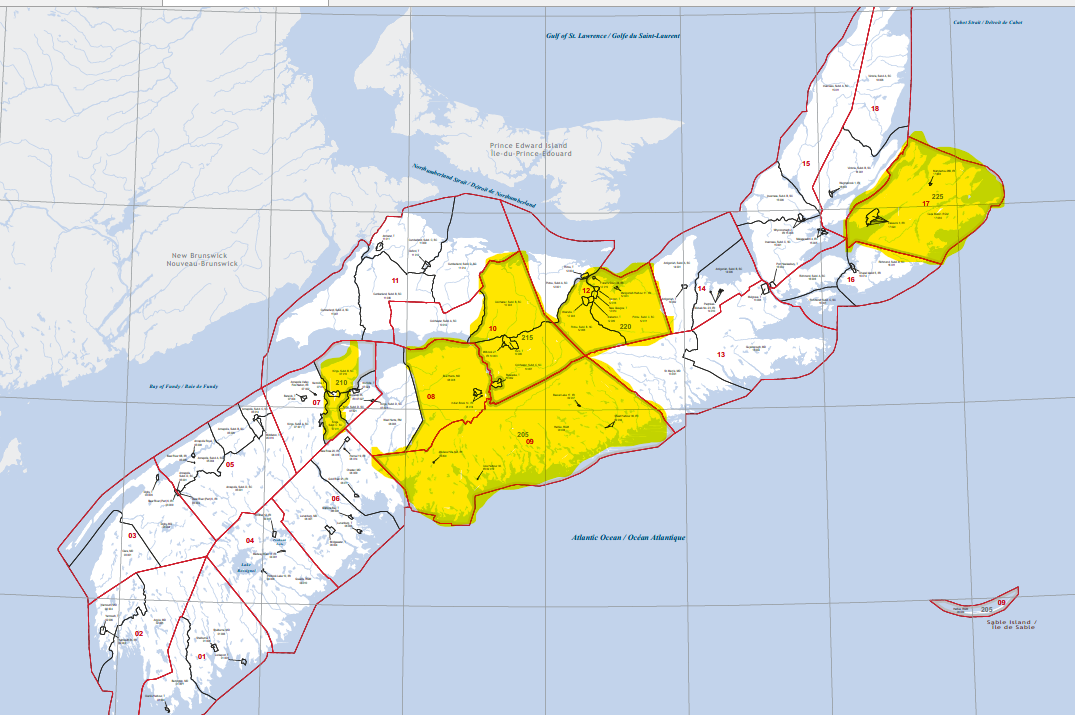

The Act also prohibits the purchase of certain prescribed real property, outlined in the regulations as including any vacant land that does not have any habitable dwellings but is

a) zoned for residential or mixed use; and

b) located within a census agglomeration or a census metropolitan area (see the map provided below) – this applies to vacant land in Halifax (census metropolitan area), as well as Kentville, Truro, New Glasgow and Cape Breton (census agglomerations).

It is an offence for non-Canadians to contravene the Act. Likewise, every person or entity who knowingly assists a non-Canadian in the purchase of residential property is in violation of the Act.

Where a corporation or entity violates the Act, every person that partakes in the violation – including officers, directors, agents, senior officials or anyone authorized to act on behalf of the corporation - is equally liable regardless of whether the corporation or entity is prosecuted.

A violation of the Act can result in liability via summary conviction and a maximum fine of $10,000.

Aside from monetary penalties, the Act authorizes a court to order the forced sale of the residential property. If this occurs, the non-Canadian cannot recover more than what they paid for the residential property. Importantly, the Act states that it does not impact the validity of a sale of residential property to a non-Canadian remains legally binding, meaning that it remains legally binding between the purchaser and seller.

This article is for information only and is not intended to be legal advice. If you have any questions or would like further information, you should consult a lawyer.